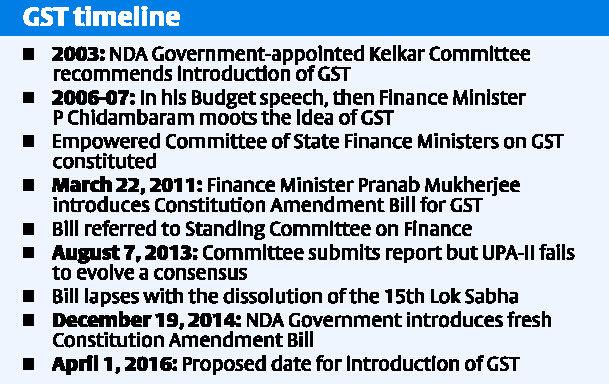

The Rajya Sabha has given a clear green signal to the GST( Goods and Services Tax) Bill which has met universal acclaim from all over the country.

Given the fact that a new amendment is sure to raise a lot of questions from all sides including from the common man, but nothing is to be feared.

The GST Bill is what economists have called a game changer in the Indian economy that will benefit entrepreneurs, manufacturers, retailers, buyers, sellers without harming the common man’s pocket.

So What Exactly is It ?

Taxes have always been a hassle for the average Indian with a charge levied on everything from entertainment to common amenities. But suppose there was a way to eliminate those taxes and centralise them into a single imposable tax that keeps everyone happy.

Seems bogus and made up but fortunately it isn’t.

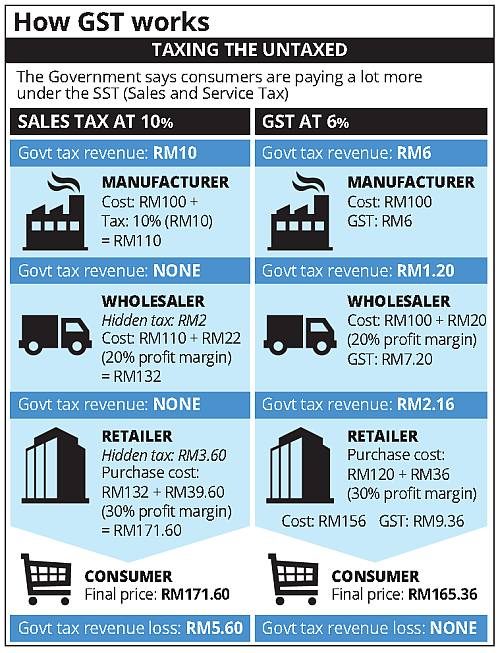

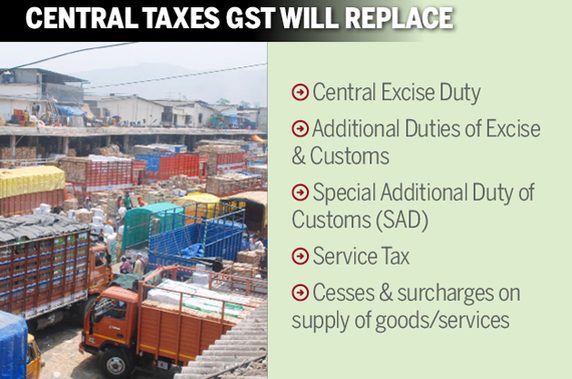

GST is a value added tax imposed at all points in the economic cycle. All credit is allowed for any tax paid on inputs acquired for use in making the supply. This would affect both goods and services with minimal exemptions.

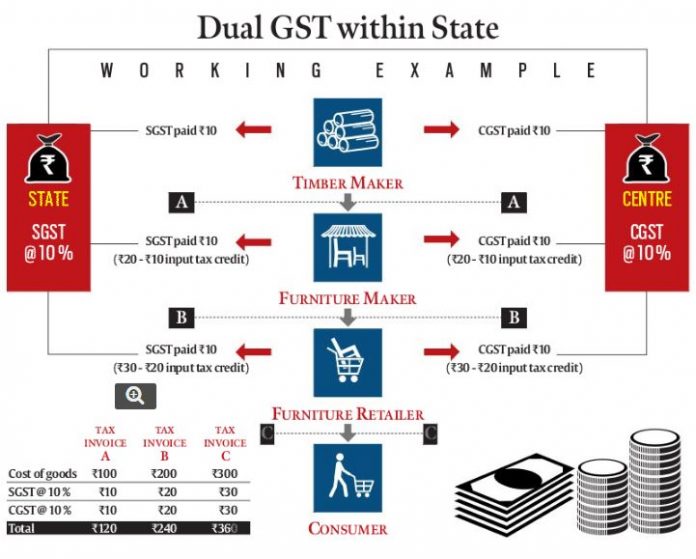

GST will be implemented at the Centre (CGST) and the States (SGST). The base and other design features would be common between CGST and SGST. Thus, exports would be zero-rated. And imports would attract the tax in the same manner as domestic goods and services. Inter-State supplies within India would attract an Integrated GST (aggregate of CGST and the SGST of the destination State).

In addition to the IGST a 1% tax has been proposed. This will be levied by the Centre. The revenue will be assigned to the origin states which will be tested for two years.

The government has planned to introduce GST by April 2017 and the tax payers need to be ready for any changes in time.

So What can We Expect in the Future ?

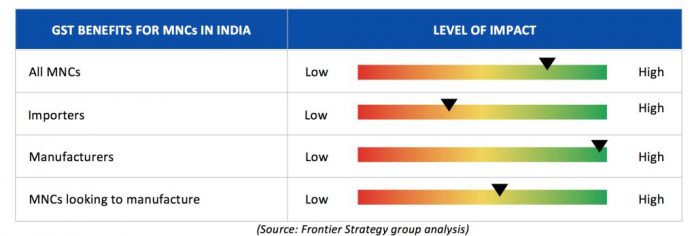

The GST magic mantra is expected to rake in some good fortunes. Not only for the country but also its investors who will enjoy additional benefits:-

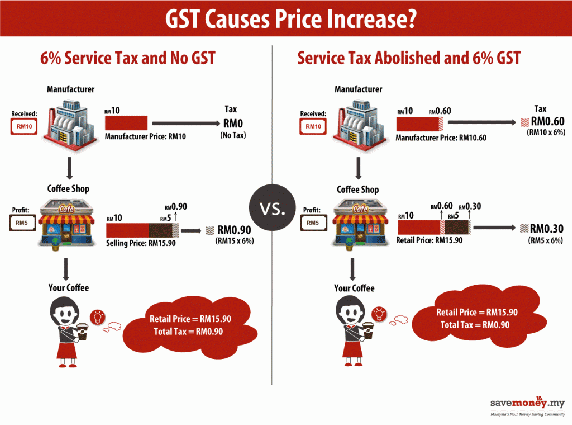

1. Lower prices on goods and services with a shift from a source based tax to a destination based tax.

2. Special incentives and economic zones for investors and entrepreneurs to set up installations at a lower capital with the merit of reasonable labour and production costs.

3. Lower taxes will be charged on retailers and manufacturers. This can later be substituted for expansion or increasing production.

4. According to experts,by implementing the Gst,India will gain $15 billion a year.This is because,it will promote more exports,create more employment opportunities & growth. It will divide the burden of tax between manufacturing and services.

If there’s any criticism of the bill whatsoever it relates to the shift the economy would have to big production giants. At the same time, the economy would take a turn for the good but with minimal development.

This will remove the basic exemption limit in excise of Rs.1.5 crore. But it’s bad for the SSI. Industries don’t have to pay an excise. But this is only if their turnover does not exceed 1.5 Crores.This had made their products cost efficient and sellable.

Click Page: 2 below to continue reading…

Discussion about this post